X CVDAY

TUTELA DEL CREDITO: THE DAY AFTER

TUTELA DEL CREDITO: THE DAY AFTER

Il mondo del credito sta attraversando cambiamenti epocali sia sul fronte privato, soprattutto bancario e finanziario, che quello della PA. Sul primo versante si sta assistendo a una rivoluzione della mappatura del mercato a colpi di accorpamenti, chiusure e assorbimenti di società all’interno delle banche o tra banca e banca. Per non parlare delle cessioni, non solo di giganteschi portafogli di crediti, ma di interi rami d’azienda. Basta confrontare le liste degli iscritti ad ABI, ASSOFIN e ASSILEA di 4-5 anni fa con quelle attuali per rendersi conto dell’entità della trasformazione in atto. Ma questi cambiamenti rischiano di apparire poca cosa rispetto alla rivoluzionea cui stiamo andando incontro, promessa dall’avanzata della tecnologia.

La digitalizzazione dei servizi finanziari, FinTech, promette infatti trasformazioni ancora più epocali, mettendo in discussione i tradizionali modelli di business. Bitcoin, blockchain, crowdfunding, robo advisor, P2P lending, alternative finance sono termini che non solo arricchiscono il vocabolario dei servizi finanziari, ma portano con loro nuovi modelli di finance e nuovi protagonisti, anche non legati strettamente al mondo del banking. Per limitarci all’ambito del sollecito e recupero dei crediti, ad esempio, c’è chi già prevede il tramonto dei grandi call center, per lo più situati all’estero, in favore dei solleciti digitali fatti di “semplici” whatsapp, SMS ed email che, in tempo reale e a costo quasi zero, consentono di pianificare solleciti sempre più stringenti e pagamenti veloci e sicuri con un semplice click.

La riforma delle norme sul recupero crediti giudiziale, chiesta a gran voce dagli investitori e dalle banche per rendere più appetibile l’acquisto delle ingenti masse di crediti in sofferenza, e quindi la loro cessione, se effettivamente velocizzerà il recupero giudiziale come promette, rischia di mettere seriamente in crisi quello stragiudiziale. Del resto, in paesi come la Svizzera, le società di recupero difficilmente si impegnano in attività come la phone collection (per non parlare della home collection, del tutto sconosciuta), spesso ritenuta inutilmente onerosa e foriera di perdita di tempo, rispetto alla rapida procedura giudiziale.

E infine, sul versante della PA, la riforma contabile sta portando avanti una logica di bilancio di cassa, piuttosto che di competenza, costringendo (finalmente) gli Enti Locali a prendere impegni di spesa commisurata a quanto effettivamente incassato e, di conseguenza, prestare molta attenzione all’effettivo recupero dei loro crediti. Questo, insieme alle recenti sentenze del TAR Puglia e Lazio, che affermano come le società di recupero crediti possono fornire un supporto agli enti locali nella gestione della riscossione delle entrate, sia tributarie che extratributarie, anche se non iscritte all’albo ministeriale, purchè non effettuino maneggio di denaro pubblico, mette in crisi la riscossione classica e apre scenari verso i privati fino ad ora del tutto sconosciuti.

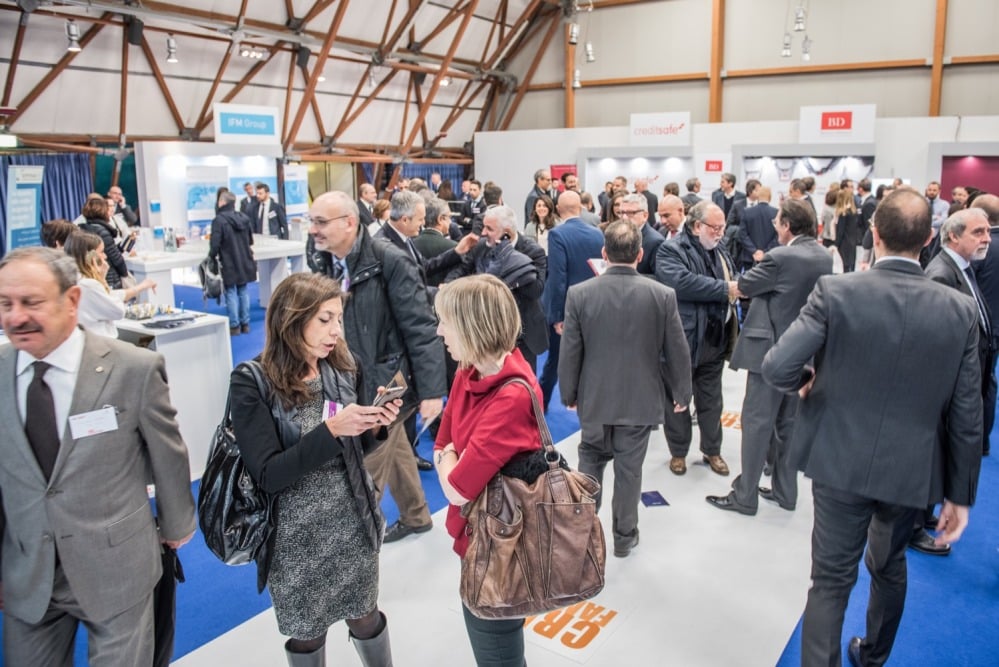

Ebbene, in questo mondo che cambia a velocità sempre più vertiginosa, gli ospiti del 10° CVDAY, il prossimo 16 novembre, cercheranno di fare chiarezza e spiegare agli operatori del settore (che nel solo ambito privato lavorano circa 45 milioni di pratiche per un recuperato di quasi 10 miliardi di euro) i pericoli e le opportunità che tali cambiamenti comporteranno a breve.

Oscar Giannino, Moderatore dei lavori della mattina

Torinese, 55 anni, Giornalista professionista, editorialista economico per il Messaggero, il Mattino, il Gazzettino, Panorama.

Conduce su Radio24 Attenti a noi 2 con Alessandro Milan il mattino, La versione di Oscar il pomeriggio,e I conti della belva il sabato. E’ stato direttore di LiberoMercato da aprile 2007 a marzo 2009.

In precedenza vicedirettore del quotidiano Finanza&Mercati, vicedirettore del quotidiano IL RIFORMISTA (2003), responsabile Economia e Finanza de Il Foglio quotidiano (1999), vicedirettore di Liberal settimanale (1997), caporedattore di Liberal mensile (1995), portavoce nazionale del Partito Repubblicano Italiano (1987-94), caporedattore de La voce repubblicana (1988).

Ha pubblicato saggi in: La politica estera della Dc (Ed.della Voce,1982), I repubblicani e l’altra Italia (Ed. Giustizia e libertà, 1987), l’Europa delle culture (Ed. Liberal libri 1996), Sicurezza: le nuove frontiere (Franco Angeli, 2005), Contro le tasse (Mondadori 2007), Il rebus Marchionne (Libero ed., 2008)

Loreto Del Cimmuto, Direttore Generale Legautonomie

E’ Direttore Generale di Legautonomie, associazione di enti locali e regionali impegnata nella rappresentanza istituzionale del sistema delle autonomie e nella erogazione di servizi di consulenza e formazione per la pubblica amministrazione locale. Ha svolto attività di ricerca e di studi sull’ordinamento e le politiche di sviluppo degli enti locali sia nell’ambito dell’Associazione come per conto di altri enti pubblici, (come Dipartimento della funzione pubblica e Formez) e centri di ricerca privati. Relatore in numerosi convegni e seminari. E’ stato consulente e consigliere di amministrazione di diverse società come SOANC spa, Fiera di Roma spa, Vice Presidente del Centro Agroalimentare Roma. E’ autore di numerosi articoli e saggi sul sistema delle autonomie e ha fatto parte di diverse commissioni di concorso e selezione del personale, comitati tecnico-scientifici di master universitari. E’ ora consigliere di amministrazione di Leganet, società partecipata da Legautonomie impegnata nella erogazione di servizi per l’innovazione della pubblica amministrazione locale.

Christian Faggella, Managing Partner La Scala Studio Legale

Managing Partner di La Scala Studio Legale dal 2009 e Membro del Consiglio di Amministrazione. Co-Responsabile dei dipartimenti di Recupero Crediti e Contenzioso bancario e finanziario dello Studio, presta consulenza e assistenza continuativa agli intermediari nella materia del diritto bancario e dei mercati finanziari.Si occupa dei progetti relativi a prodotti di risparmio gestito (compresi i fondi di investimento, hedge fund e i prodotti strutturati), della redazione dei documenti d’offerta e della contrattualistica di settore, nonché della quotazione di società e strumenti finanziari nei mercati regolamentati. È membro del Comitato Crediti di primarie società e gruppi industriali che assiste nell’organizzazione del processo di recupero crediti, coordinando l’area collection small ticket. Partecipa abitualmente come relatore e docente a corsi e convegni in materia di contenzioso finanziario e bancario e recupero crediti.

Giovanni Falcone, Amministratore di Alfa Recupero Crediti

Cresciuto nell’impresa di famiglia fondata dal padre Agostino, attraverso la gestione dei mandati finanziari, Giovanni Falcone ha acquisito la direzione dell’azienda nel 2014 condividendola con il fratello Luca. Il core business di Alfa Recupero Crediti è il servizio recupero stragiudiziale per le Pubbliche Amministrazioni, attività esplorata da Alfa nel 2000, sviluppata attraverso la gestione di oltre 100 enti locali e tuttora fiore all’occhiello dell’impresa campana. Parallelamente all’ambito pubblico, Alfa Recupero Crediti eroga servizi a tutela del credito ad importanti realtà bancarie e finanziarie, imprese, utilities ed organizzazioni di categoria, supportando il ciclo del credit management dalla fase di prevenzione a quella di gestione, recupero stragiudiziale e giudiziale e veicolando operazioni di cessione del credito per PMI.

Massimo Famularo, Blogger, Editorialista esperto di gestione del credito

Massimo Famularo è attualmente consigliere d’amministrazione per Frontis NPL e Haed of Italian NPLS per Distressed Technologies, è membro del Gerson Lehrman Group Council dal 2009, ed è stato director per Algebris Investments Italy sino a maggio 2016. In precedenza ha ricoperto il ruolo di responsabile del Servizio Sofferenze per Cariparma Credit Agricole; Portfolio manager per Jupiter Finance (ora Cerved Credit Management) e Portfolio Analyst per Archon Group Italia (Loan Servicer captive Goldman Sachs in Italia). Inoltre è stato Management Consultant per Oliver Wyman. Massimo ha conseguito la laurea in Economia con lode presso la Luiss Guido Carli di Roma, è stato winning solver of Innocentive Challenge: “Systems to Monitor Institutional Corruption”, collabora con Credit Village, Strade on Line, Noisefromamerika e ha due blog sul Fatto Quotidiano e Linkiesta.

Roberto Ferrari, Direttore Generale CheBanca!

È stato inserito nella lista dei Top Fintech40 Power People in Europa stilata nel 2016 e 2015 dal Financial News (WSJ) e nella lista del 2016 e 2015 Digital Banking Club Power 50 dei servizi finanziari digitali europei.

Membro del Consiglio di Amministrazione di Mediobanca Innovation Services. Vanta oltre venticinque anni di esperienza manageriale sia in ambito italiano che internazionale. Ha conseguito un Master of Science in Public Policy presso la University College of London (UCL).

Andrea Ferri, Responsabile della Finanza locale presso Anci

Responsabile della Finanza locale presso Anci, dirige il Dipartimento Finanza locale dell’IFEL (Istituto per la finanza e l’economia locale). Laurea in Statistica, esperto della disciplina e delle tecniche di gestione e riscossione delle imposte locali, ha collaborato alla definizione e al monitoraggio delle norme attuative del Federalismo fiscale (legge. n. 42 del 2009), al processo di decentramento delle funzioni catastali (2007-2009) e alla definizione ed avvio operativo del sistema di perequazione delle risorse comunali basato sui fabbisogni e le capacità fiscali standard (2014-16).

Antonio Fontanelli, Fondatore Creditcare

Antonio Fontanelli, Avvocato Cassazionista specializzato nella gestione stragiudiziale e giudiziale dei crediti , attualmente attraverso lo Studio Legale Fontanelli in Roma gestisce posizioni per importanti aziende del settore energetico, automotive (societa’ captive) , nonché’ nel settore previdenziale e finanziario creditizio. Fondatore di Creditcare Srl, società altamente specializzata nei servizi di gestione flotte e crediti da renting e leasing, NPL e crediti P.A, tramite questa , nel 2016 dopo anni di attenta osservazione del mercato dei servizi per la collection dei crediti, ha inventato e brevettato a livello mondiale il nuovo servizio AWC Automatic Web Collection, un servizio totalmente automatizzato che consente in tempi rapidi di poter gestire un numero infinito di posizioni, recuperandone ove possibile i crediti e fornendo al cliente ogni possibile report sull’attività svolta, e’ un cambio di direzione storico per la collection dei crediti che da oggi si avvicina piu’ ad un servizio IT da integrare nei servizi gia’ presenti nei processi aziendali senza andare in outsourcing, con risparmio di costi e tempi.

Francesco Generoso, Responsabile del Governo degli Outsourcer Crédit Agricole CariParma

Responsabile del Governo degli Outsourcer per il Gruppo Crédit Agricole CariParma da dicembre 2014. Attività di recupero crediti tramite operatori specializzati in phone/home collection sulla clientela del segmento Retail dai primi segnali di early warning e fino alle Inadempienze Probabili (pre-DBT). Si è occupato del kick-off del Progetto e della sua messa a terra, avvenuta a giu-15. L’attività progettuale prosegue nel 2017 con una seconda fase evolutiva. Nel Gruppo CariParma Crédit Agricole dal 2008, con precedenti esperienze nel Credit Risk Management. In precedenza, si è occupato a vario titolo di Marketing, Finance, Business Intelligence nelle prime realtà di internet/home banking (ING Direct, BNL).

Roberto Lorini, Senior Executive Management Advisory Consulting PWC

Roberto Lorini ha una esperienza senior globale nel mercato ICT, che copre i trend tecnologici, i prodotti e i servizi, l’integrazione di sistemi, la consulenza, la creazione di innovazione con start-up e FinTech per grandi clienti e diversi mercati. E’ stato membro del Consiglio dell’Associazione Italiana dei fornitori ICT, ha guidato la divisione Applicazioni, Soluzioni di Business Intelligence e Datawharehouse di Oracle e ha fondato e guidato aziende confluite nel Gruppo Value Team (oggi NTT Data). Dal 2014, Roberto copre la funzione di Technolgy Partner nella Practice di PwC Advisory focalizzata sulla consulenza digitale e tecnologica per i Servizi Finanziari. Lavora con clienti primari bancari su una vasta gamma di servizi che spaziano dalla strategia e governance ICT, soluzioni ERP e Business Intelligence, Digital framework, customer experience, marketing, servizio clienti, Big Data e sicurezza. In PwC è anche alla guida del Programma FinTech italiano correlato ad analoghe iniziative negli Stati Uniti e in Europa.

Ovidio Marzaioli, Vicepresidente Forum UNIREC-CONSUMATORI

Vicesegretario Generale Movimento Consumatori e Segretario Generale di Consumers’ Forum e membro supplente CNCU.

Avvocato civilista dal 1991, impegnato attivamente nel settore consumeristico dal 2001 ha consolidato la sua esperienza nel settore Ambiente ed Energia in qualità di responsabile MC dal 2007. In tale ambito è rappresentante CNCU del comitato di consultazione degli utenti TERNA, membro del gruppo di lavoro dell’AEEGSI con nomina ministeriale dal 2009 e master nei rapporti con le aziende energetiche aderenti alla conciliazione paritetica (Enel, Eni, Edison, Sorgenia, Acea, Eon, Iren).

Già docente al Master di etica degli affari del consumo e della responsabilità sociale presso l’università di Siena nel 2012 ed al Master di II livello in Globalizzazione dei Mercati e Tutela dei Consumatori presso l’Università degli studi Roma Tre, ha consolidato in questi anni la propria esperienza nell’ambito della formazione professionale specialistica in tema di “ADR di Consumo”, “Gestione del Credito e Compliance Aziendale”, “Settore Bancario e Finanziario”.

Dal 2014 è membro del Council del progetto europeo R&Dialogue condotto dall’Università di Roma La Sapienza con il coinvolgimento di 17 partner di 10 paesi europei al fine di favorire il dialogo tra organizzazioni sul tema delle tecnologie low carbon e la riduzione delle emissioni di CO2.

E’ cofondatore e Vicepresidente del Forum UNIREC-CONSUMATORI per favorire il dialogo tra le imprese di gestione e recupero crediti ed i consumatori.

Sergio Menchini, Professore Ordinario di Procedura Civile presso la Facoltà di Giurisprudenza dell’Università di Pisa e Of Counsel LMCR Studio Legale Associato

Ha insegnato diritto processuale civile, diritto dell’arbitrato e diritto fallimentare presso le Università di Pisa, di Siena di Ferrara e di Firenze. E’ membro del Comitato di Direzione delle Riviste di Diritto Processuale Civile, Il Giusto Processo e Le Nuove Leggi Civili Commentate. Svolge attività di Avvocato, con particolare riferimento all’assistenza davanti alle Corti Superiori e in sede arbitrali. Si occupa prevalentemente di diritto civile e di diritto dell’impresa, nonché del diritto dell’arbitrato e fallimentare. Opera in collaborazione con lo Studio Lmclex di Milano.

Andrea Mignanelli, Fondatore e AD Cerved Credit Management

Andrea Mignanelli è fondatore e amministratore delegato di Cerved Credit Management, società leader nella gestione di crediti problematici per conto di istituzioni finanziarie e investitori.

In precedenza Mignanelli è stato partner di McKinsey & Co., responsabile europeo della Credit Risk Management Practice. Prima ancora, dal 1994 al 1997 ha lavorato in General Electric come analista finanziario presso le filiali di Londra, New York e Rio de Janeiro.

Laureatosi in Economia e Commercio presso l’Università Luigi Bocconi, Mignanelli ha proseguito la sua formazione con un Master in Business Administration presso INSEAD (Francia).

Antonella Pagano, Country Manager Lindorff Italy

Antonella Pagano e’ entrata nel Gruppo Lindorff nel Maggio 2016 con il ruolo di Country Manager per l’Italia. Prima di unirsi a Lindorff Antonella e’ stata partner di PwC, dove per 17 anni si e’ occupata di tematiche di Corporate Finance con specifico focus nei settori non-performing loans (NPL) e financial restructuring.

Marco Pasini, Presidente UNIREC

Dopo significative esperienze manageriali in comparti industriali, è fondatore e AD di un’importante impresa del comparto di tutela del credito, alla quale si sono aggiunte ulteriori iniziative imprenditoriali sempre nell’ambito dei servizi della tutela del credito. Ha partecipato dalla prima ora al movimento associativo che nel 1998 ha portato alla nascita di UNIREC, e nel triennio 2012-2015 è stato membro del Consiglio Direttivo dell’Associazione, con delega allo sviluppo del mercato nella Pubblica Amministrazione. Da maggio 2015 riveste il ruolo di Presidente.

Dario Maria Spoto, Head of Planning, Control e Cost Management Gruppo Banca Popolare di Bari

Attualmente Head of Planning, Control e Cost Management del Gruppo Banca Popolare di Bari, ha realizzato la prima cessione di NPLs con GACS e curato tutto il percorso volto alla trasformazione in S.p.A., in linea con gli obiettivi del Piano Industriale di Gruppo.

Principali ambiti di competenze su Risk Management (credit risk, ALM, market risk, liquidity risk), Business-Financial Planning, IAS/IFRS, Securitizations, NPLs disposal, metodologie di pricing di strumenti finanziari, classificazione e valutazione del portafoglio creditizio.

In precedenza, a supporto del Commissario Straordinario di Banca Tercas, responsabile della ristrutturazione interna e della complessa operazione di uscita dall’Amministrazione Straordinaria del Gruppo bancario abruzzese nel 2014.

Dal 2003 al 2012 in Deloitte, dapprima in qualità di auditor nel financial institution group per poi passare all’unità di Strategy di Deloitte Consulting dove diviene Senior Manager nel corso del 2011.

Mike Tribuzio, Coach e Formatore

Mike Tribuzio, in arte “zio Mike”, Manager, Formatore, Autore, Editore, Docente del corso di Alta Formazione in “Comunicazione Strategica” presso la School of Management Università LUM Jean Monnet, e profondamente appassionato di psicosomatica, fisiognomica, grafologia e sociologia. In oltre 30 anni di esperienza, ha approfondito tematiche di Management e Comunicazione di massa, Motivazione, Team building, Leadership, PNL e Coaching con trainer di prestigio internazionale come Tony Robbins, John Grinder, Deepak Chopra. Dal 1982, mette le sue competenze al servizio delle più grandi aziende di vendita diretta in Italia, contribuendo alla selezione, consulenza e formazione di migliaia di manager e professionisti.

Zio Mike è autore di diversi libri e DVD tra cui:

Il successo ti sta cercando … non ti nascondere! (libro)

Vuoi diventare il più grande venditore del 3° Millennio? Fai della tua vita un capolavoro! (libro)

Capirsi al primo sguardo (Fisiognomica -Psicosomatica – Semiotica) (DVD)

Rapport is Power! (DVD).

Francesco Tuccari, Vice Presidente di FireGroup

Dopo un’esperienza iniziale presso una banca commerciale (Cassa di Risparmio V.E.), entra a far parte della Consob nel 1986, ricoprendo incarichi di crescente responsabilità, divenendo in successione responsabile dell’Ufficio Ispettorato Intermediari, dell’Ufficio Vigilanza Intermediari ed infine dell’Ufficio Insider Trading. Nel 2000 assume il ruolo di Direttore Generale della Banca Intermobiliare di Investimenti e Gestioni Spa. Nel 2002 diviene Con-Direttore Generale della Banca Popolare Commercio & Industria SpA del Gruppo Bancario UBI, incarico che ricopre fino al 2011. Dal 2011 assume l’incarico di Direttore Generale della Banca Popolare di Spoleto. Dal settembre 2015 è Vice Presidente di FireGroup SpA. Laureato in Giurisprudenza presso l’Università degli Studi di Messina, ha conseguito un Master alla SDA dell’Università Bocconi di Milano; successivamente, l’APC in Finance alla Business School della New York University.

Sergio Trovato, Avvocato tributarista

Avvocato tributarista, Giornalista-Pubblicista, Consulente di Italia Oggi, Esperto per 15 anni de Il Sole 24 Ore, Consulente scientifico “Leggi D’Italia”, Consulente Anci, Consulente Legautonomie. Autore di libri e di numerose pubblicazioni in materia tributaria e processuale. Componente del Comitato scientifico di direzione del progetto nazionale di studio e ricerca sul principio costituzionale del buon andamento e la sua effettività nelle pubbliche istituzioni, della Scuola Superiore della Pubblica Amministrazione. Consulente di società private e amministrazioni pubbliche.