IX CVDAY

ATTENTI AL LUPO…

In questi anni di crisi, il settore della tutela del credito ha assunto sempre più un ruolo macroeconomico cruciale. In un’economia in cui:

- il PIL pro capite ha perso il 9%;

- il tasso di disoccupazione sfiora il 13%, e quella giovanile sfonda quota 44%;

- le banche hanno tassi di crediti deteriorati che varia tra il 10% ed il 25%;

- il sistema giudiziario si caratterizza per una patologica lentezza, con la durata media dei procedimenti civili di 7.4 anni;

il ricorso ai canali stragiudiziali per il recupero dei crediti appare il baluardo per arginare la spirale di incertezza, bassi investimenti, credit crunch e scarso cash flow che ha carat- terizzato l’attuale congiuntura.

Partendo da questi temi, il Dipartimento di Economia dell’Università di Genova, ha effet- tuato uno studio basato sui dati del V° rapporto UNIREC (maggio 2015), e ne ha ricavato spunti interessanti.

Dal rapporto risulta che l’importo complessivo dei crediti recuperati dalle imprese operanti nel settore sia di circa 10 miliardi (di cui 5.7 recuperati nel solo ambito bancario) su 56 miliardi totali di crediti affidati.

Tanto per dare un ordine di grandezza a questi dati, lo studio fa un paragone con quanto recuperato dall’Agenzia delle Entrate che, con un numero di addetti – i cui costi sono a carico dei contribuenti – pari al doppio di quelli delle imprese UNIREC (che non costano nulla alla comunità), e con gli strumenti coercitivi di cui gode, in un anno riesce a recupe- rare una cifra poco superiore, pari a 14 miliardi di euro di lotta all’evasione fiscale.

Ma la parte più rilevante dell’indagine dell’Università di Genova consiste nel tentativo di quantificare l’impatto sul PIL di tali importi. Purtroppo, attualmente, non esistono tecniche di stime degli effetti sul reddito totale del recupero crediti nei settori non bancari, ma anche limitando l’indagine solo al settore bancario e basandosi su analisi effettuate dall’FMI, l’indagine dell’Università è arrivata alla conclusione che i 5.7 miliardi di euro di crediti recuperati per conto delle banche dalle Imprese associate ad UNIREC implicano un incremento del PIL pari a 2.1 miliardi di euro in 4 anni. Pari, ad esempio, al 70% del costo di Expo. superiore al (presunto) “tesoretto” di Padoan che era di 1,6 miliardi, supe- riore alla cifra necessaria per colmare il gap tra reddito familiare ed il 50% della povertà assoluta, calcolato in 1.5 miliardi €.

Pertanto si parla di una cifra di tutto rispetto, che conferma la rilevanza del settore della tutela del credito per l’economia del nostro Paese.

Ebbene, se queste sono le premesse, occorre rilevare come in questi ultimi due anni il settore stia vivendo in uno stato d’incertezza assolutamente micidiale. Ancora peggio- re, forse, dell’epoca della famigerata Circolare Masone (fatta annullare dall’associazione di Categoria che ricorse a strasburgo). sotto il fuoco delle pesantissime sanzioni delle Autorità di vigilanza, sembrano svanite le (poche) certezze conquistate dal ’96 ad oggi.

E le domande si rincorrono: anche in Italia si prospetta un rischio Americano dove sollecitare un debitore che ha già pagato espone a pesanti azioni risarcitorie?

Come è possibile che in un Paese della UE sia consentito recuperare crediti vestiti in maniera buffa (vedi el cobrador del frac spagnolo), rendendo palese a tutto il vicinato lo stato di insolvenza del debitore e da noi, per il rispetto delle stesse normative UE, è un problema anche solo parlare con un familiare del debitore?

Può il sacrosanto rispetto dei diritti dei consumatori portare al blocco di un sistema che vale svariati punti di PIL e costituisce ossigeno puro per la nostra asfittica economia?

È forse vero che, in alcuni casi, processi industriali consolidati, sono stati tanto esasperati dalla richiesta di performance e abbassamento delle tariffe da imporre la sostituzione della negoziazione con l’ossessione?

Come uscire da questa situazione e rilanciare il settore?

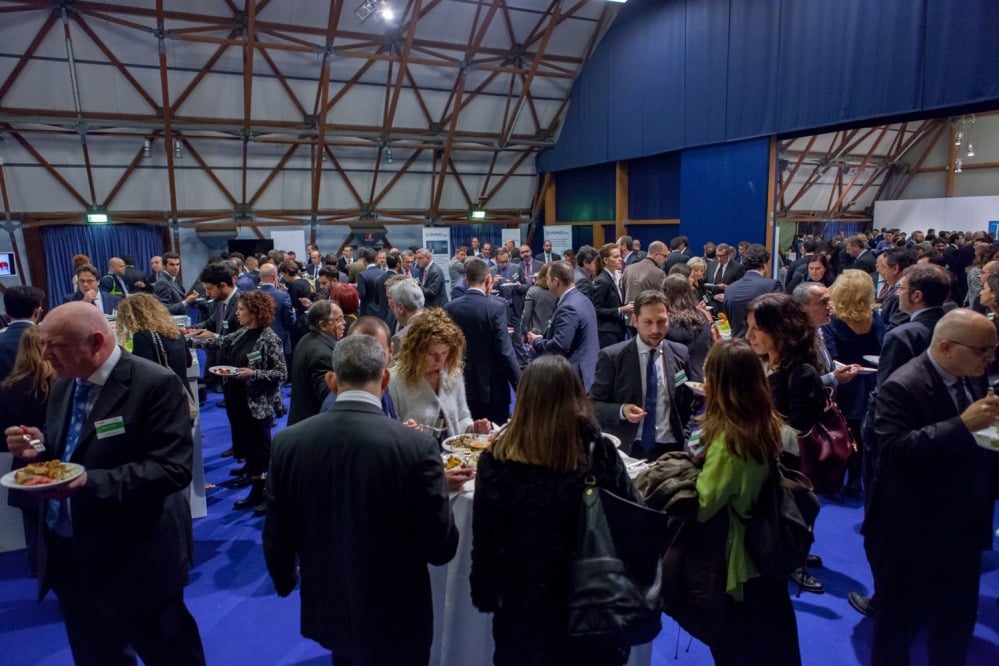

Queste ed altre scottanti questioni saranno affrontate con i diretti protagonisti in una tavola rotonda, il prossimo 2 dicembre al Crowe Plaza di Milano, nel consueto appuntamento di autunno del CVDAY.

Patrick Morris CEO ACA International

Patrick J. Morris è CEO presso ACA International da giugno 2011. Patrick Morris ha ricoperto in precedenza il ruolo di Vice Presidente Esecutivo della National Association of Federal Credit Unions (NACFU) di Arlington, in Virginia dal 2007 al 2011. Negli anni precedenti Morris è stato Direttore Esecutivo dell’International Committee for Information Technology Standards, basato a Washington, un’organizzazione accreditata di sviluppo di standards e leader nello sviluppo di standard globali di tecnologia dell’informazione e Segretario Generale dell’ International Federation for Produce Coding. Patrick Morris ricopre il ruolo di Executive in ambito associativo da oltre 16 anni e possiede una grande esperienza di questioni regolamentari e legislative, di affari internazionali e del settore dei servizi finanziari.

Melania Sebastian Presidentessa ANGECO

Presidente di ANGECO (Asociacion Nacional de Entidades de Gestion del Cobro) dal 2013. Melania Sebastian è Ingegnere delle Telecomunicazioni laureta all’Università Politecnica di Madrid e possiede un Master in Business Admnistration. E’ Direttrice generale della società spagnola GESIF dal 2004 . In passato ha svolto cariche presso la banca spagnola Caja Madrid nel settore commerciale, banking, media e organizzazione sistemi. Ha tenuto lezioni in svariate scuole di business e tiene corsi, seminari e conferenze

Gabriele Cardullo Dipartimento di Economia dell’Università di Genova

Professore associato di politica economica presso il Dipartimento di Economia, Università degli Studi di Genova. Ha conseguito il dottorato in Economia e Metodi Quantitativi presso l’Université catholique de Louvain (Belgio) nel 2007. I suoi interessi di ricerca riguardano l’economia del lavoro e la macroeconomia. Ha pubblicato su importanti riviste internazionali quali European Economic Review, Labour Economics, Journal of Public Economic Theory.

Massimo Ferrero Responsabile della Direzione B (comunicazioni, finanza e assicurazioni) AGCM

Fabio D’Atanasio Amministratore Delegato MARAN CREDIT SOLUTION S.p.A.

Nasce a Spoleto nel 1970 e la sua esperienza professionale è tutta legata alla Maran Credit Solution S.p.A., società specializzata nei servizi in outsourcing per la gestione del credito e tra i principali attori del recupero del credito in Italia, di cui è anche socio.

Entra nel mondo del Credito quando, agli inizi degli anni ’90, decide di intraprendere l’attività di esattore domiciliare affianco al fratello Nazzareno. In seguito all’espansione della società, ha partecipato e contribuito alla creazione della prima rete macroregionale di recuperatori domiciliari, sviluppandola sull’intero territorio nazionale.

Dal 2000 è amministratore della divisione di phone collection e tutt’ora cura lo sviluppo e l’organizzazione del settore home collection. Dal 2015 è diventato A.D.o della Maran. E’ tra i fautori della scelta di continuità del gruppo Maran, che la rende tra le poche società del settore a non impiegare più personale con un “contratto di collaborazione a progetto”, avendo dato seguito alla stabilizzazione di tutto il proprio staff. E’ consigliere UNIREC E del Forum UNIREC-CONSUMATORI, di Confindustria sede di Spoleto del comitato esecutivo di Ebitec.

Umberto Filotto Segretario Generale ASSOFIN

Professore Ordinario di Economia delle Aziende di Credito presso l’Università di Roma “Tor Vergata”, dove insegna Retail Banking, docente senior SDA Bocconi e Segretario Generale Assofin (Associazione Italiana del Credito al Consumo e Immobiliare), carica che ricopre dal 1992. È co-editor del Rapporto sul Sistema Finanziario della Fondazione Rosselli e membro del Comitato di redazione di Bancaria. Siede nel Consiglio Direttivo del Conciliatore Bancario e Finanziario.

In Europa è membro del Board di Eurofinas, nel cui ambito presiede il Comitato Statistiche e Legislazione.

È autore di numerose pubblicazioni, anche internazionali, sui temi bancari e finanziari.

Renato Grassini Amministratore GE.RI S.r.l.

Classe 1955, scopre la passione per il mondo del Credito con Dun&Bradstreet per poi affermarsi in Citi.Nel 1994 decide di fondare Ge.Ri. Gestione Rischi, società specializzata nella Gestione e nel Recupero del Credito. Nel 2003, in un’ottica di diversificazione del business nasce Elliot, azienda dedicata al Business Processing Outsourcing perla Prevenzione del Rischio e il Customer Management. Nel 2013 inizia l’affermazione internazionale, con l’inaugurazione della prima sede estera in Francia, a Lione. Ad oggi GERI HDP, la Holding che governa le aziende del Gruppo, conta oltre 500 dipendenti con 4 sedi in Italia e altrettante in Europa ed è associata ad UNIREC, Federpol e Fenca.

Francesco Luongo Consigliere FORUM UNIREC CONSUMATORI e Vicepresidente Nazionale Movimento Difesa del Cittadino

Avvocato dal 2001, cassazionista, attivo da sempre nel settore dei diritti civili e nella tutela dei cittadini, è esperto in diritto dei consumatori. E’ Vicepresidente Nazionale del Movimento Difesa del Cittadino, associazione di consumatori, in cui cura le problematiche giuridiche legate a finanza, gestione del credito, servizi a rete (energia, servizi idrici, comunicazioni elettroniche e postali) al diritto d’autore, nonché ai rapporti con le Authorities indipendenti di regolazione. Partecipa a numerosi tavoli istituzionali sulla regolazione dei mercati con l’Autorità per l’Energia Elettrica ed il Gas, l’Autorità per le Garanzie nelle Comunicazioni, l’AGCM ed il Garante della Privacy.

Luca Ottolini Credit & Litigation Manager Iren Mercato S.p.

Ha seguito in differenti funzioni (marketing, vendite, after sales e gestione credito) e diverse aziende (3M Italia, Edison, Enìa, Iren Mercato) i rapporti con vari segmenti di clientela dai distributori ed operatori dentali ai clienti business e residenziali del mercato energetico. Da questi osservatori operativi ha assistito da subito al processo di trasformazione del mercato del gas naturale iniziato nell’anno 2000, concentrando l’attenzione sulla gestione in generale della clientela e più in particolare degli aspetti legati al credito.

La sua posizione gli consente di confrontarsi ogni giorno con il contesto economico delle aziende e delle famiglie italiane, con le problematiche operative in un ambito multi territorio e con l’evoluzione della normativa di settore e generale: questi elementi comportano il porre, quindi continua attenzione alle modalità di gestione dei processi del credito ed al necessario sviluppo delle risorse umane in esii coinvolte.

Marco Pasini, Presidente UNIREC

Dopo significative esperienze manageriali in comparti industriali, è fondatore e AD di un’importante impresa del comparto di tutela del credito, alla quale si sono aggiunte ulteriori iniziative imprenditoriali sempre nell’ambito dei servizi della tutela del credito. Ha partecipato dalla prima ora al movimento associativo che nel 1998 ha portato alla nascita di UNIREC, e nel triennio 2012-2015 è stato membro del Consiglio Direttivo dell’Associazione, con delega allo sviluppo del mercato nella Pubblica Amministrazione. Da maggio 2015 riveste il ruolo di Presidente.